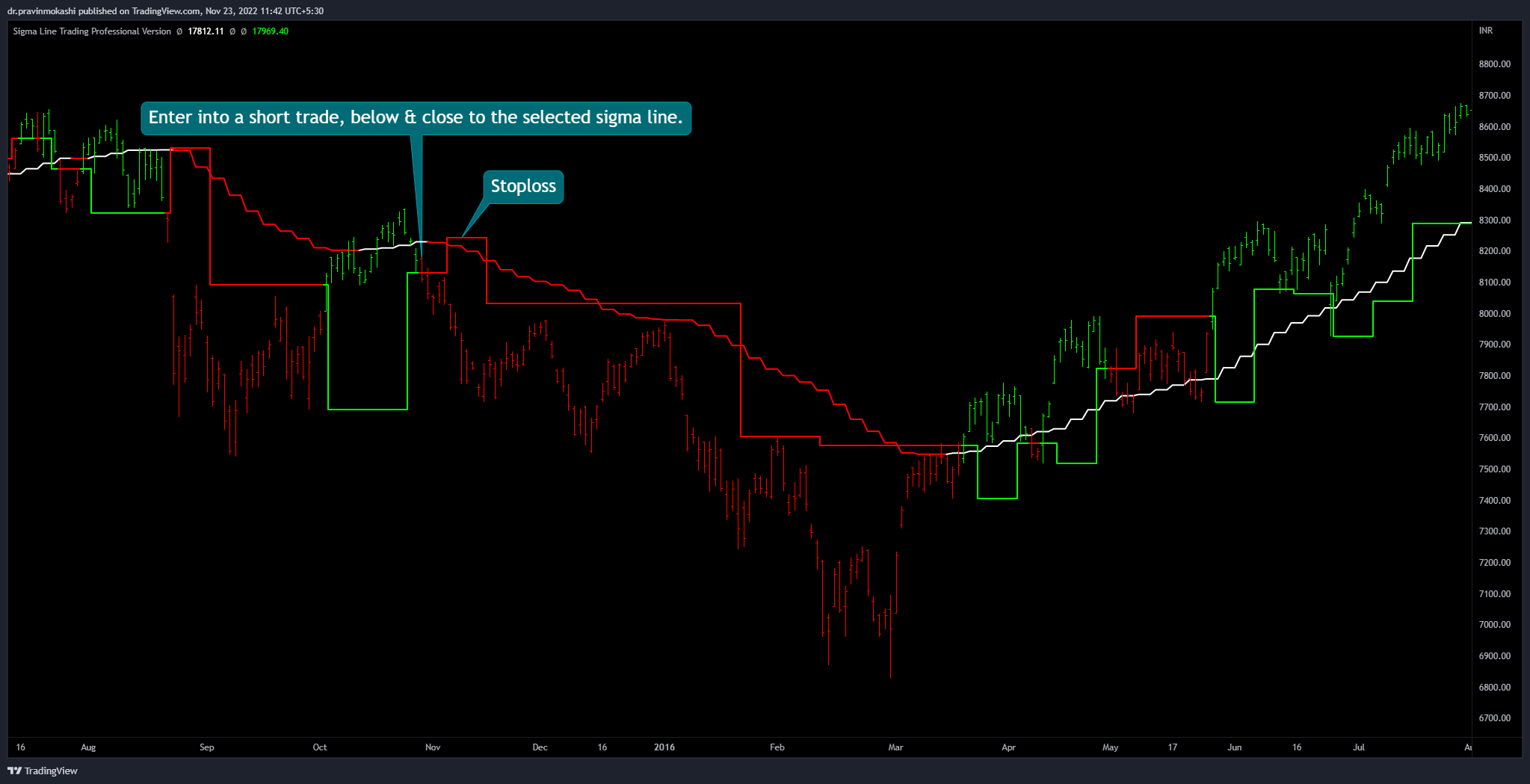

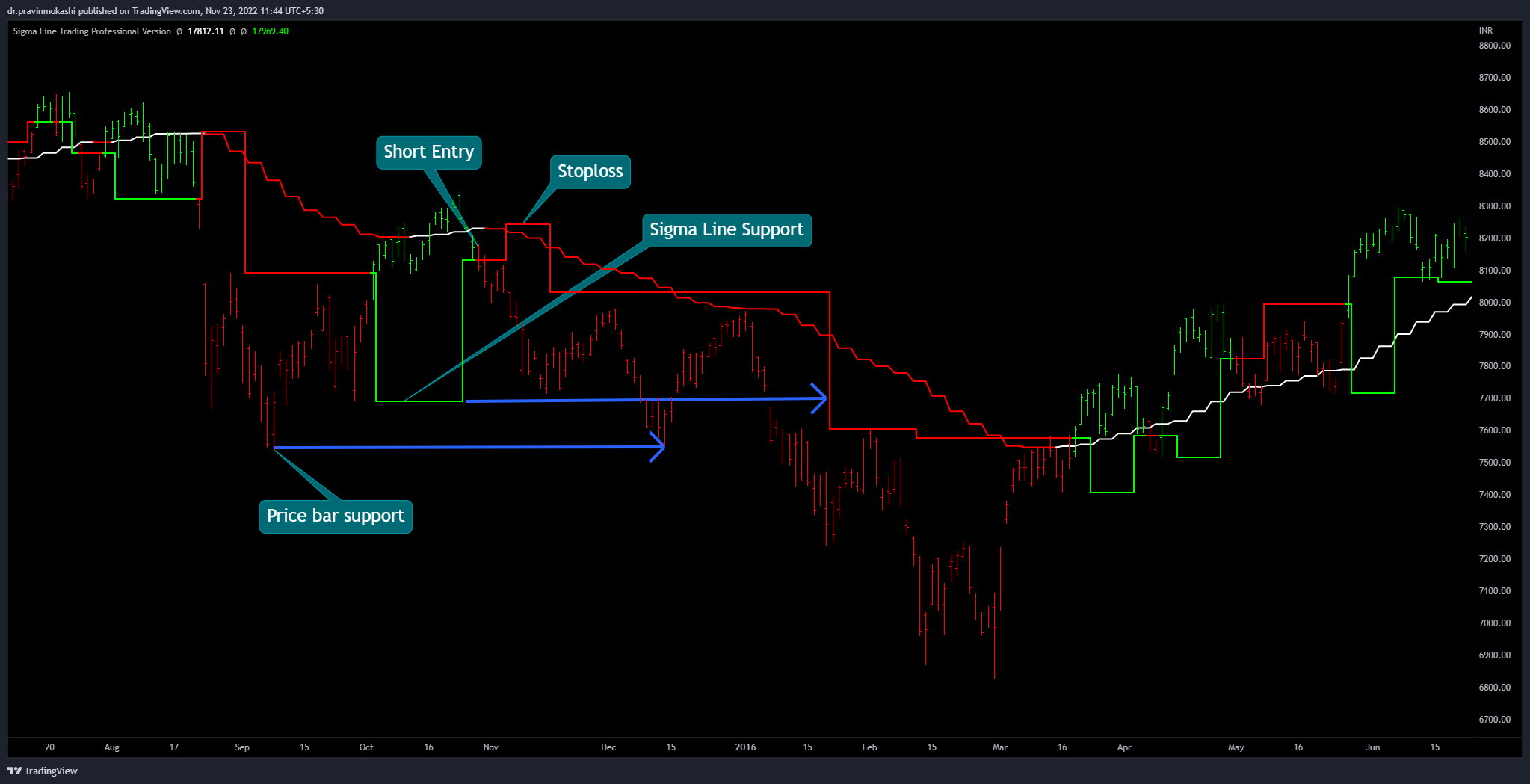

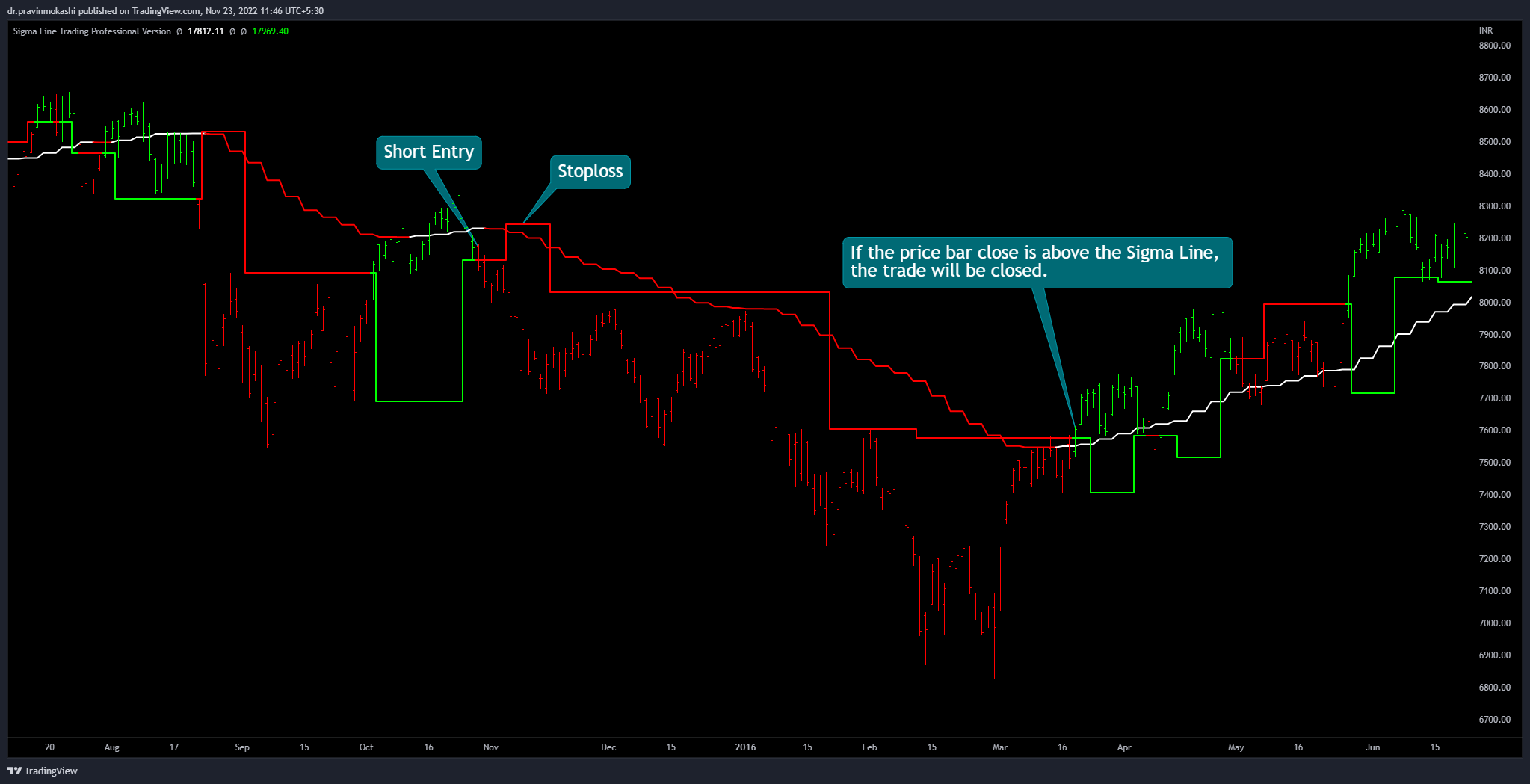

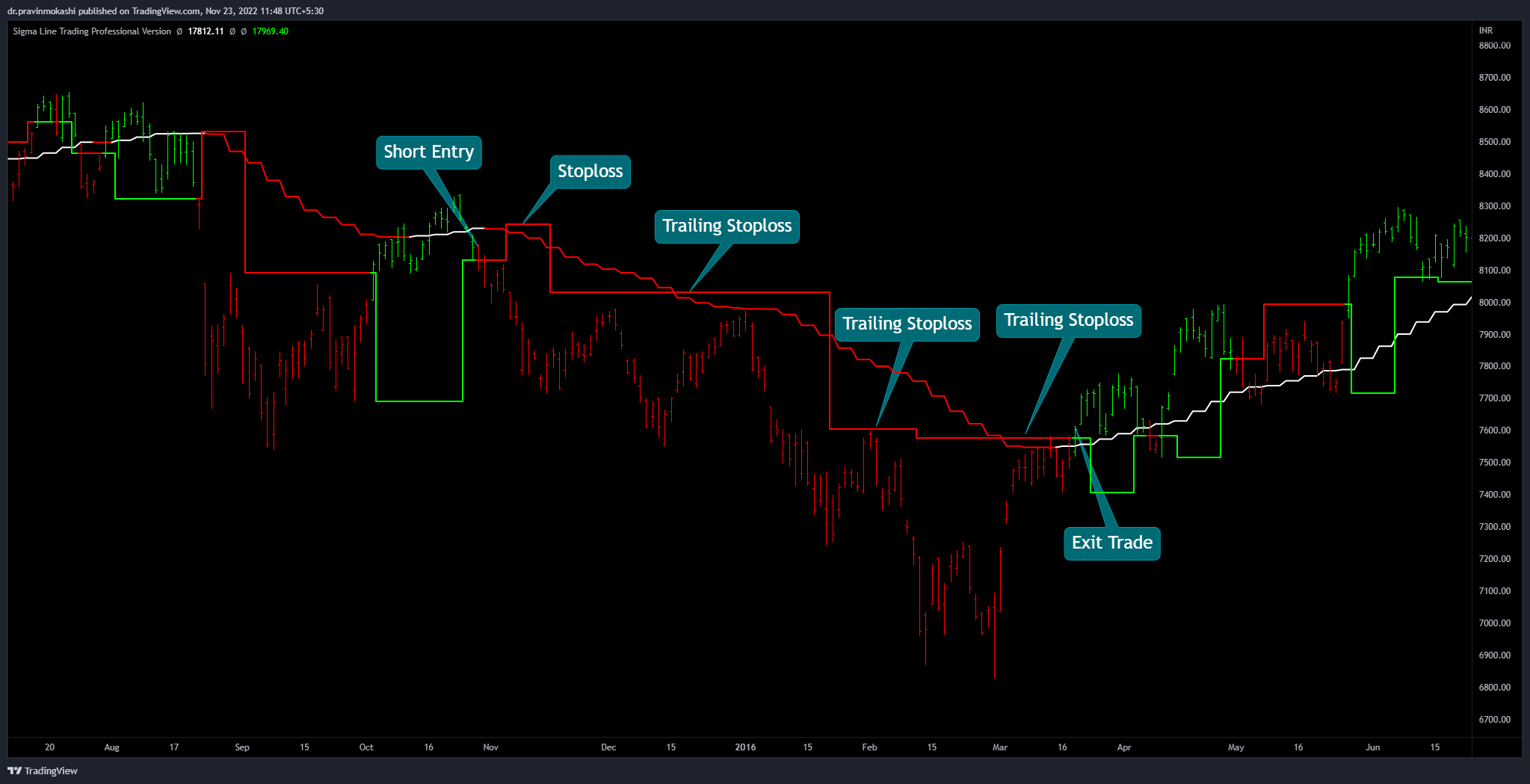

Sigma-line system is the simplest & the most effective method of trading & investing. Anyone & everyone can learn it easily within no time. It is effective in cash & derivative segments of all the markets of traded financial securities.

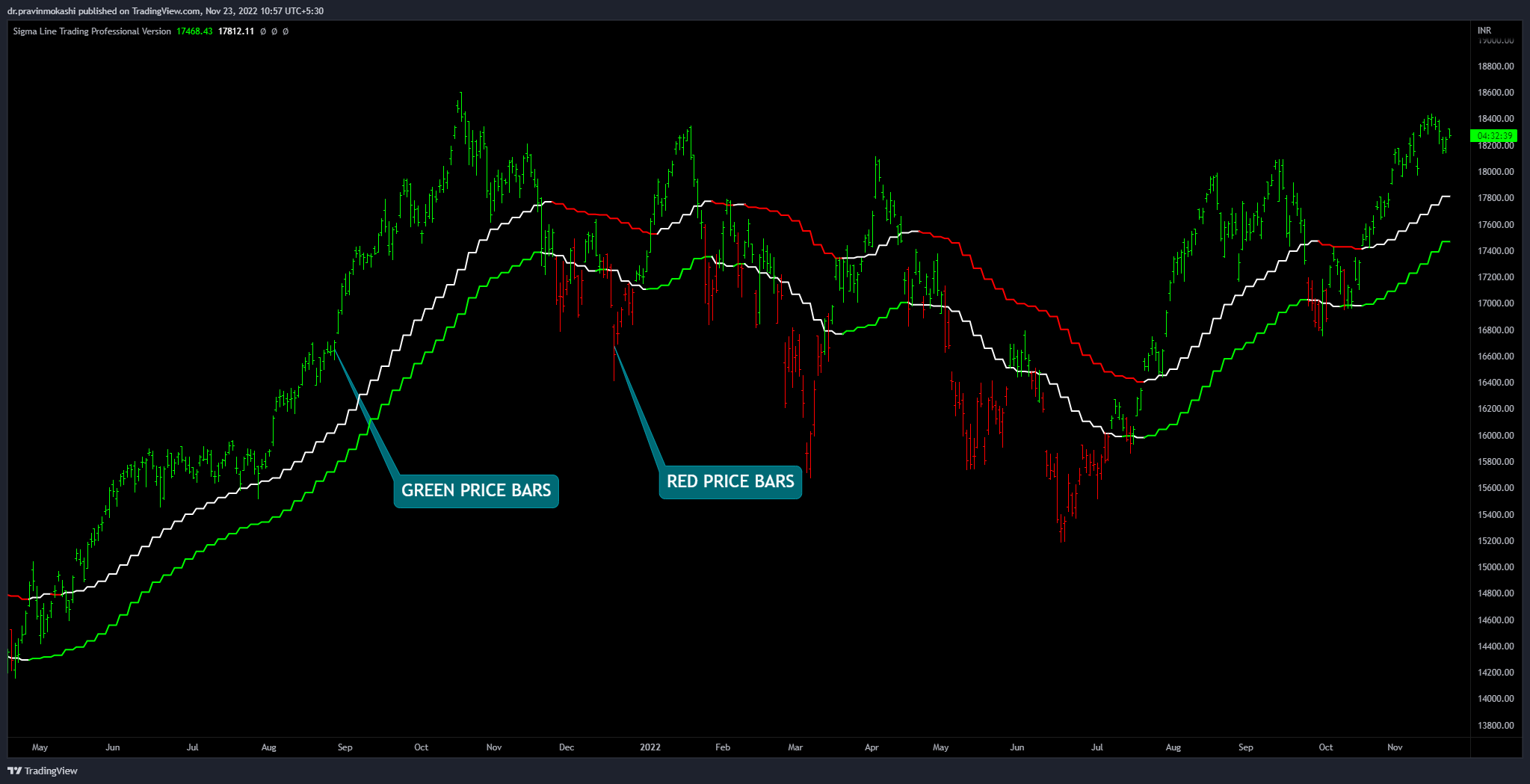

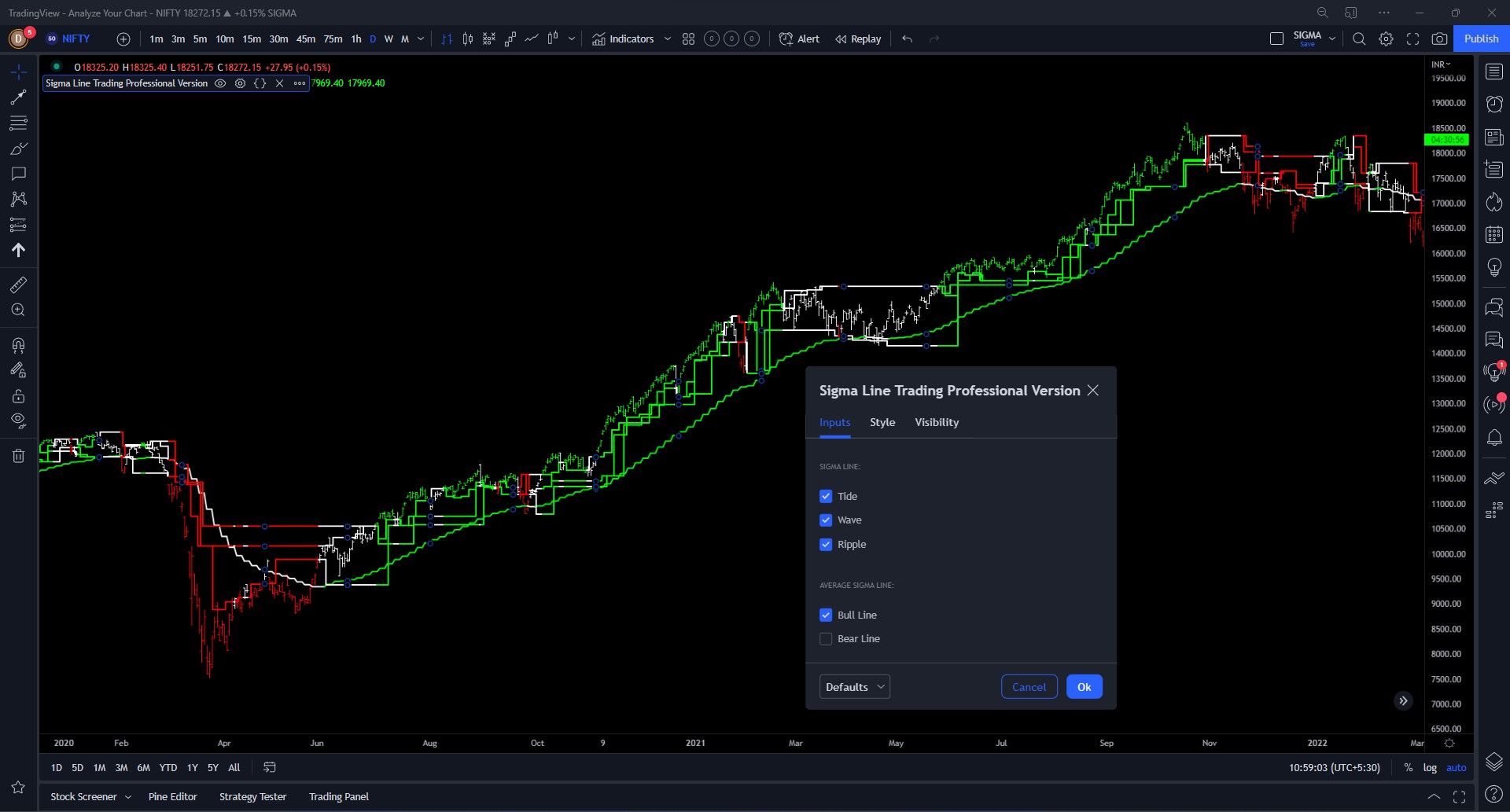

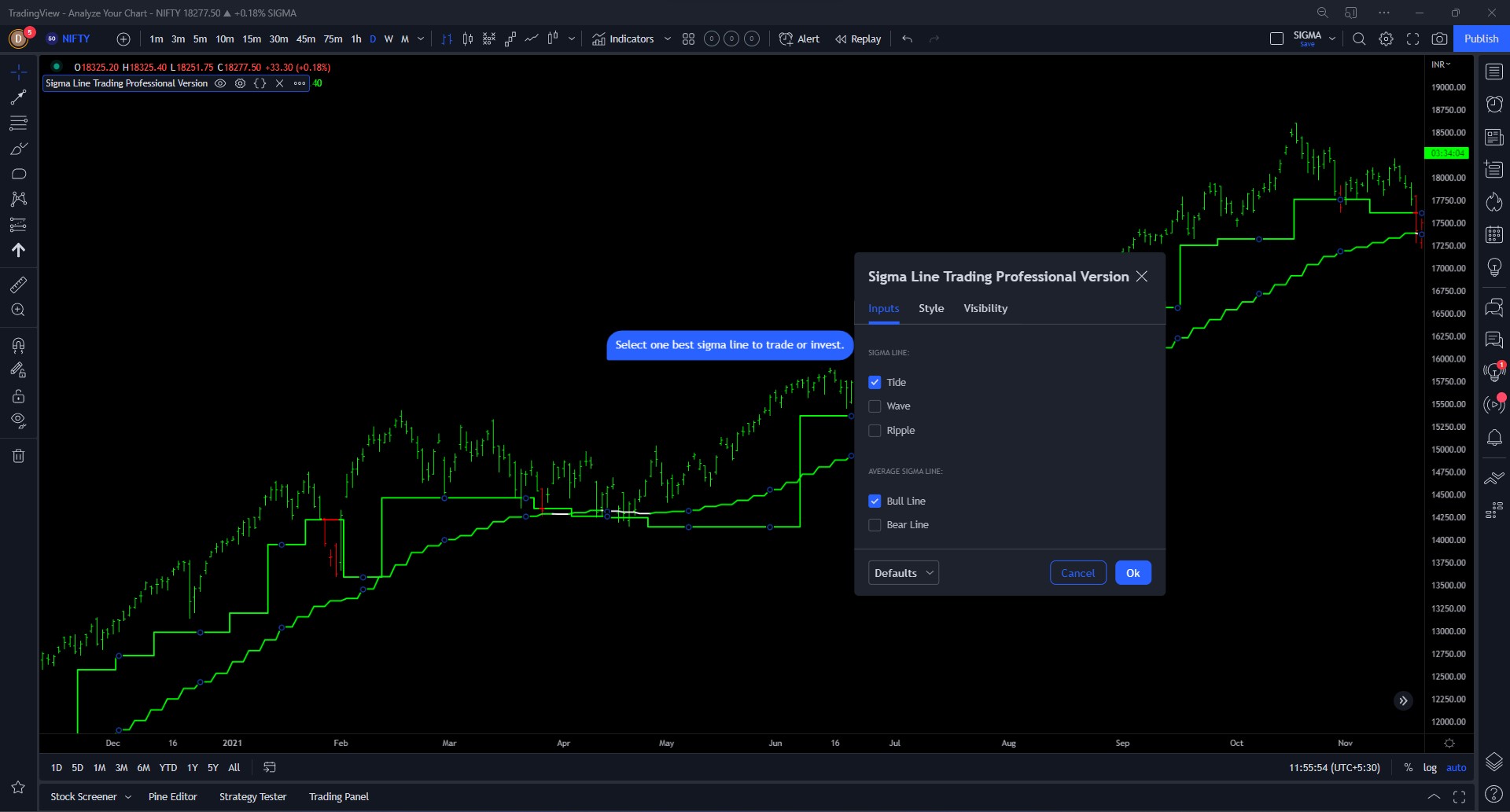

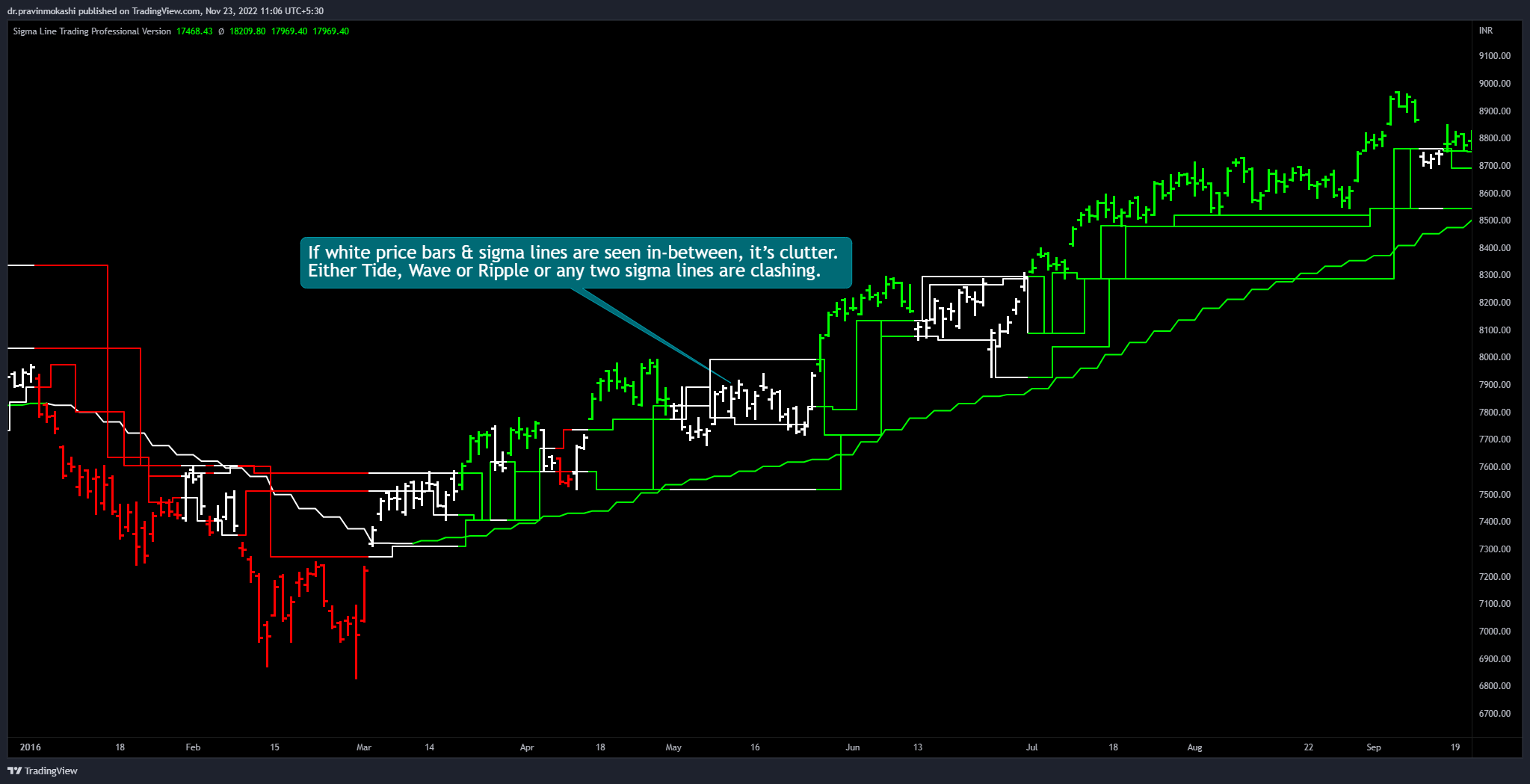

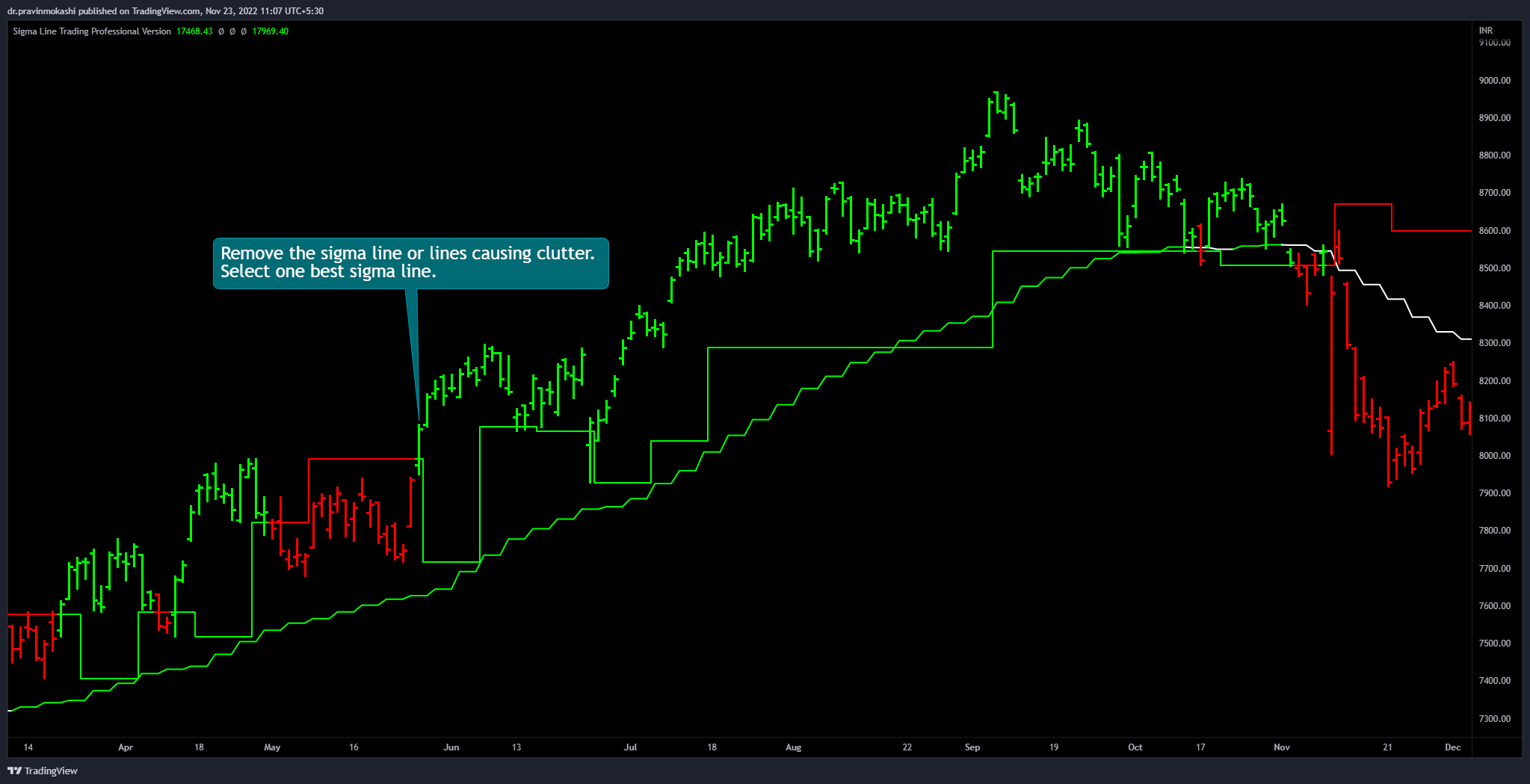

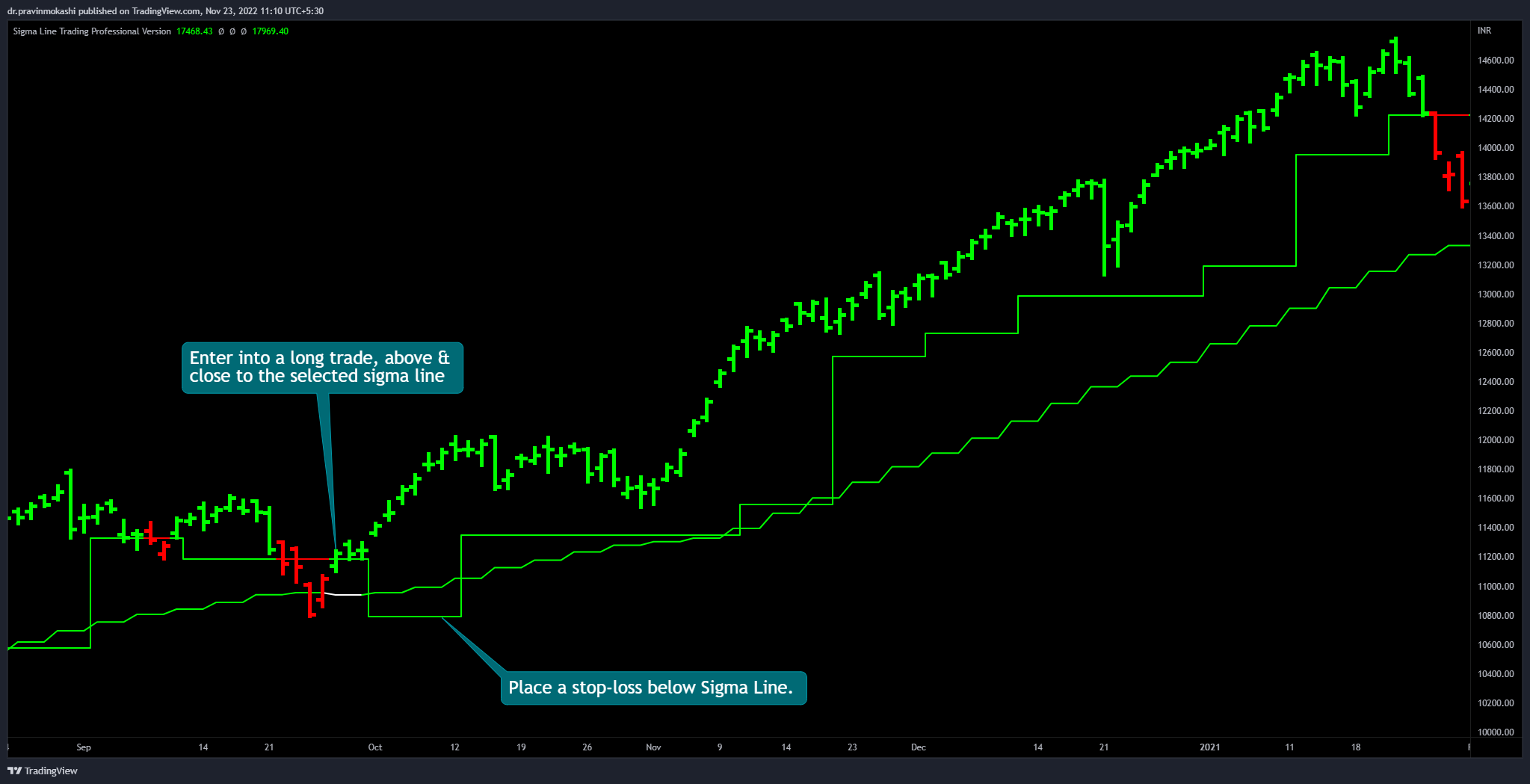

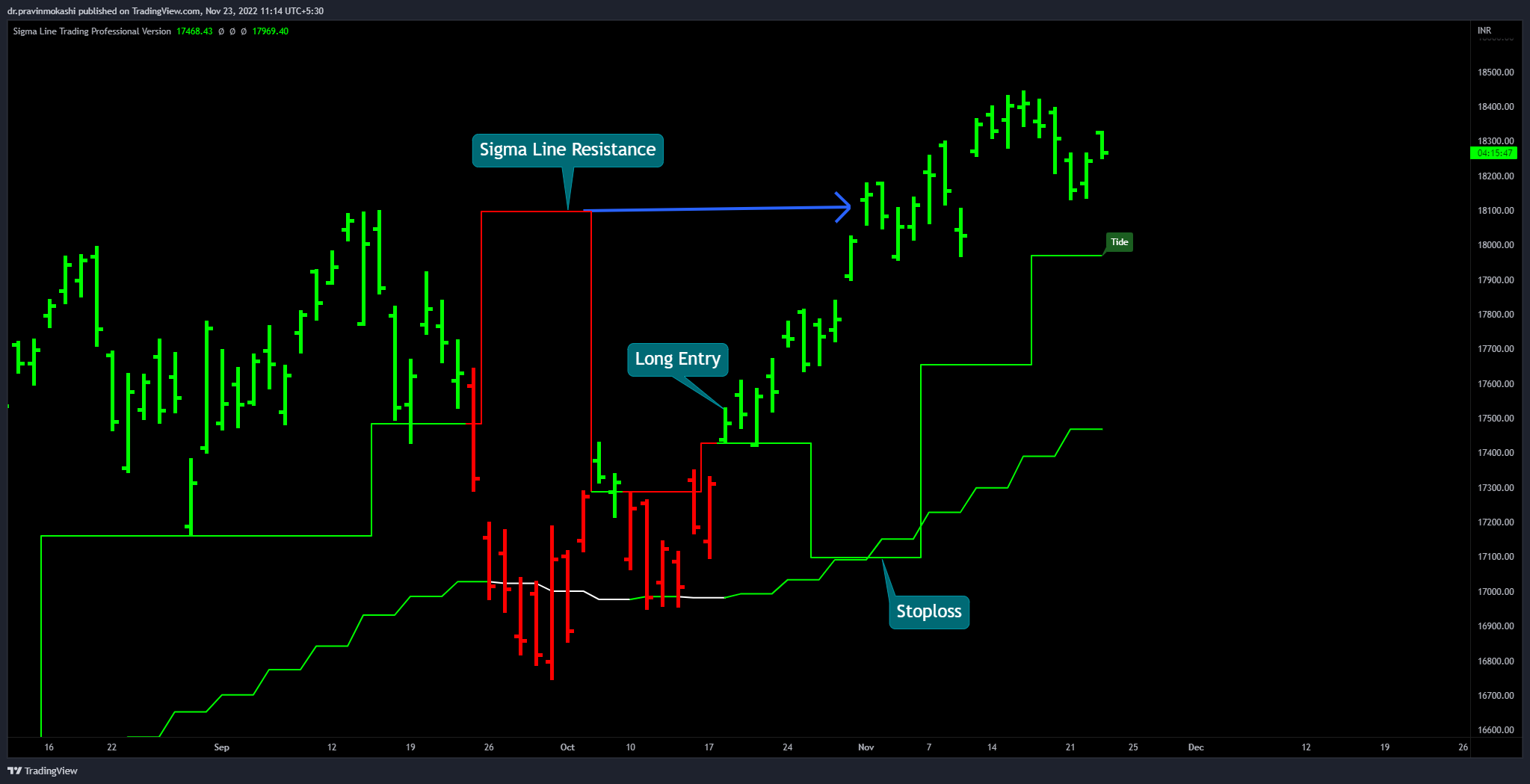

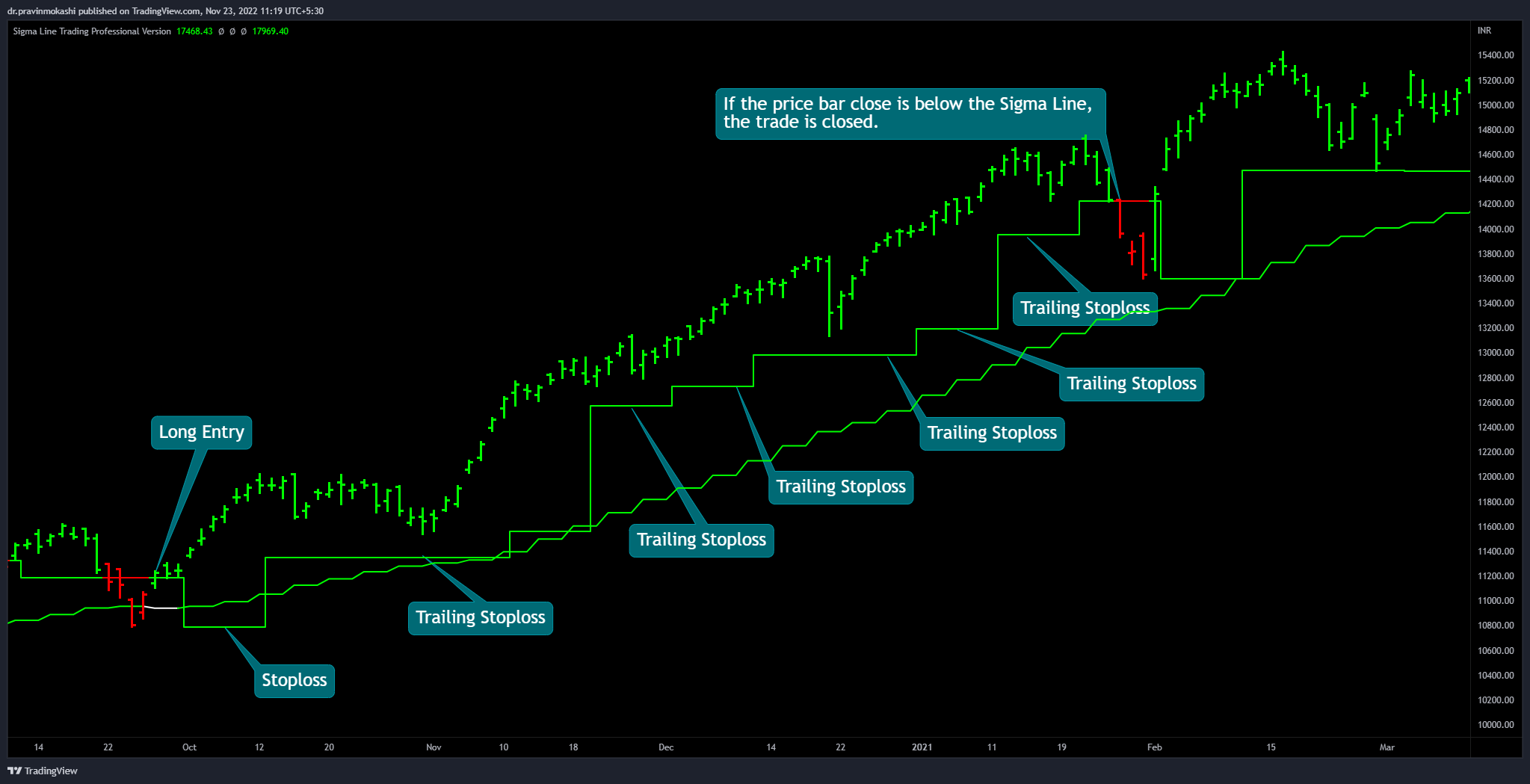

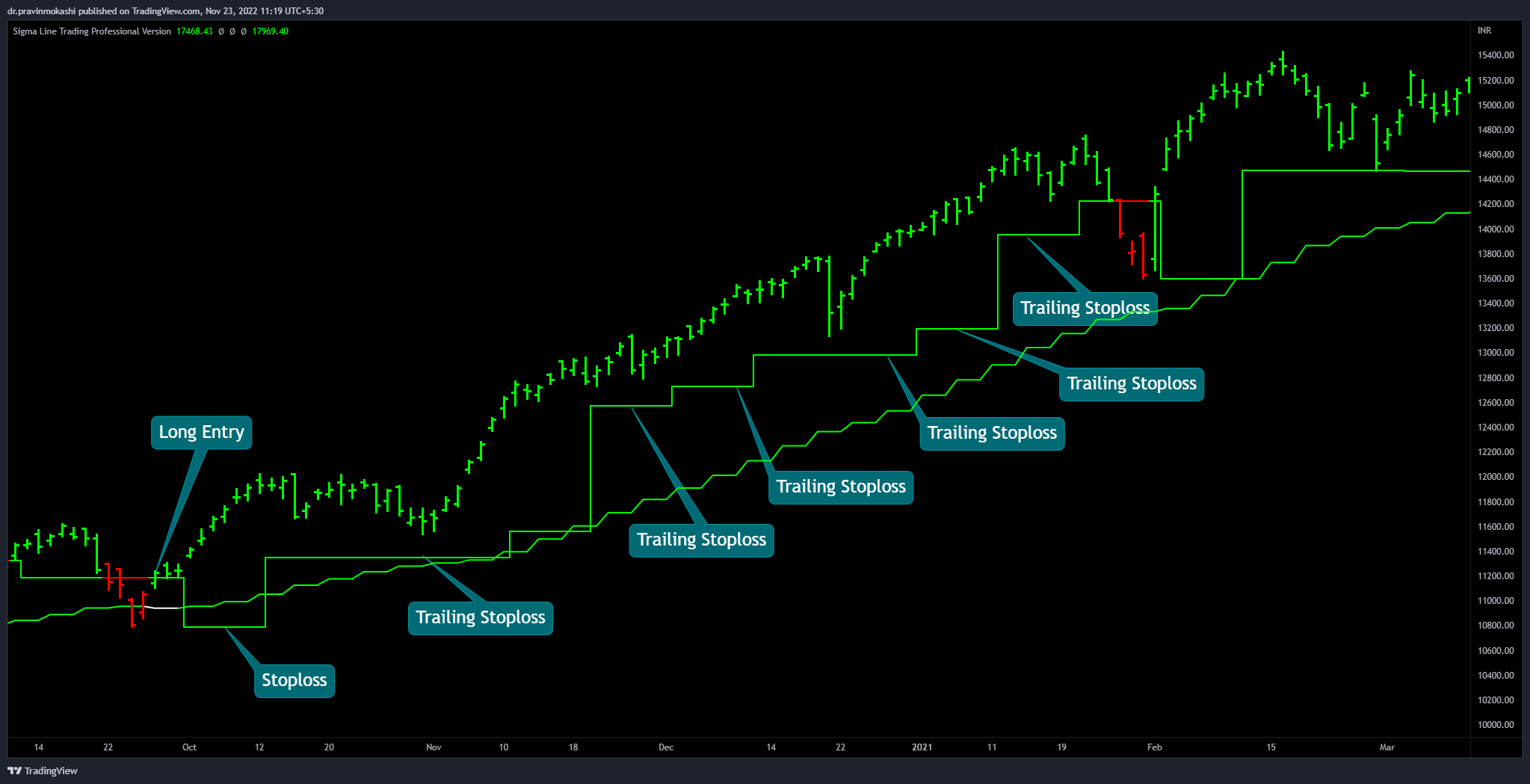

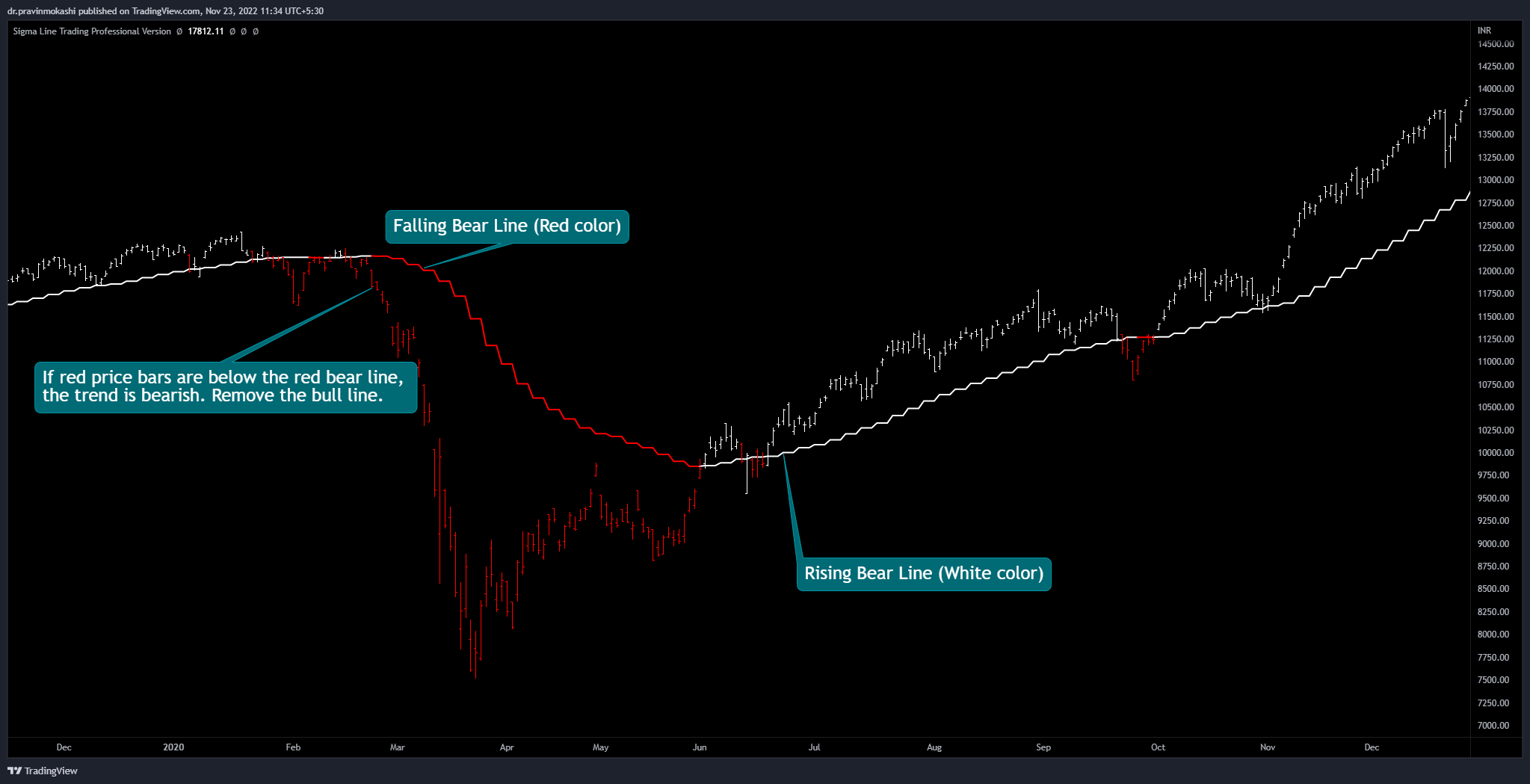

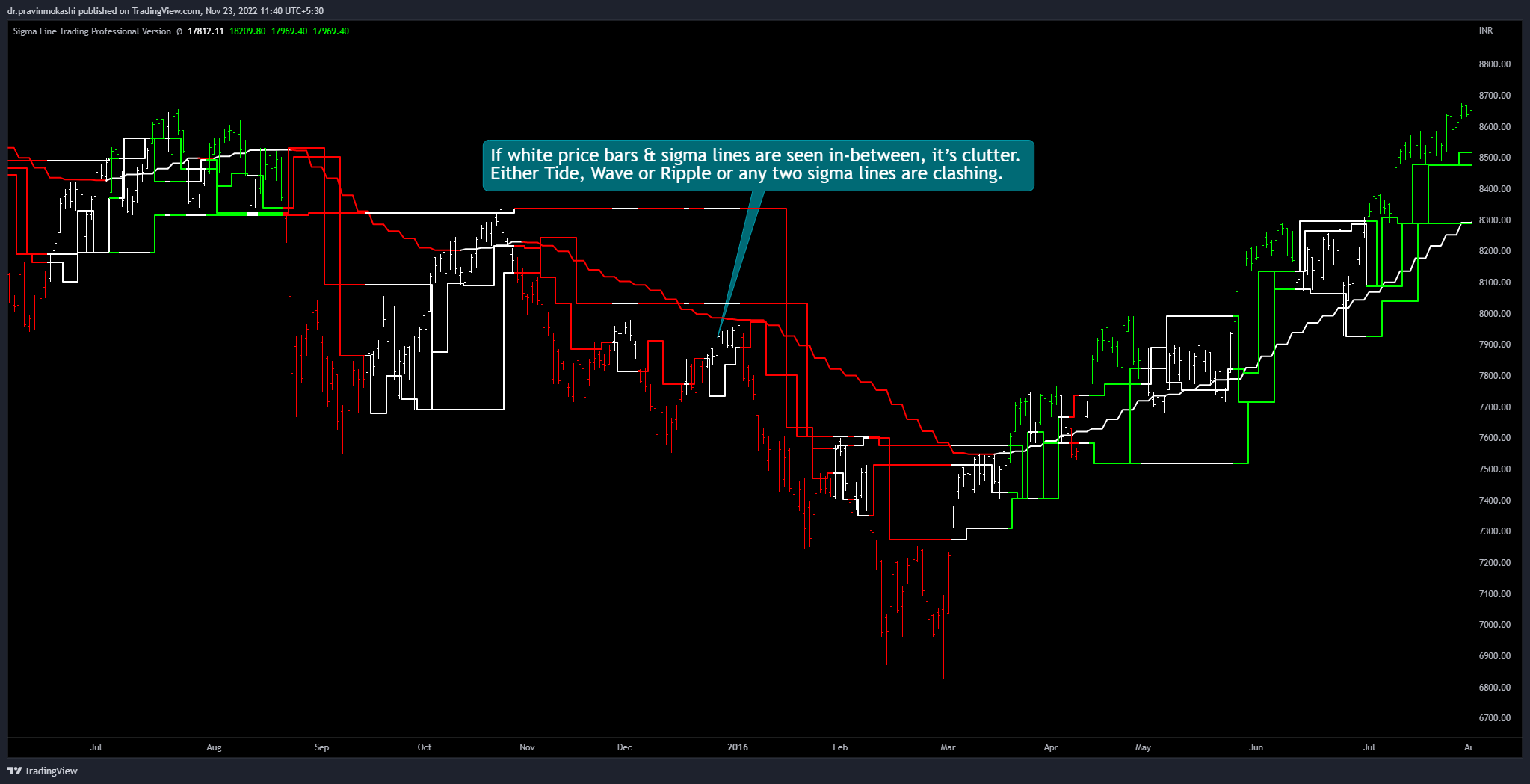

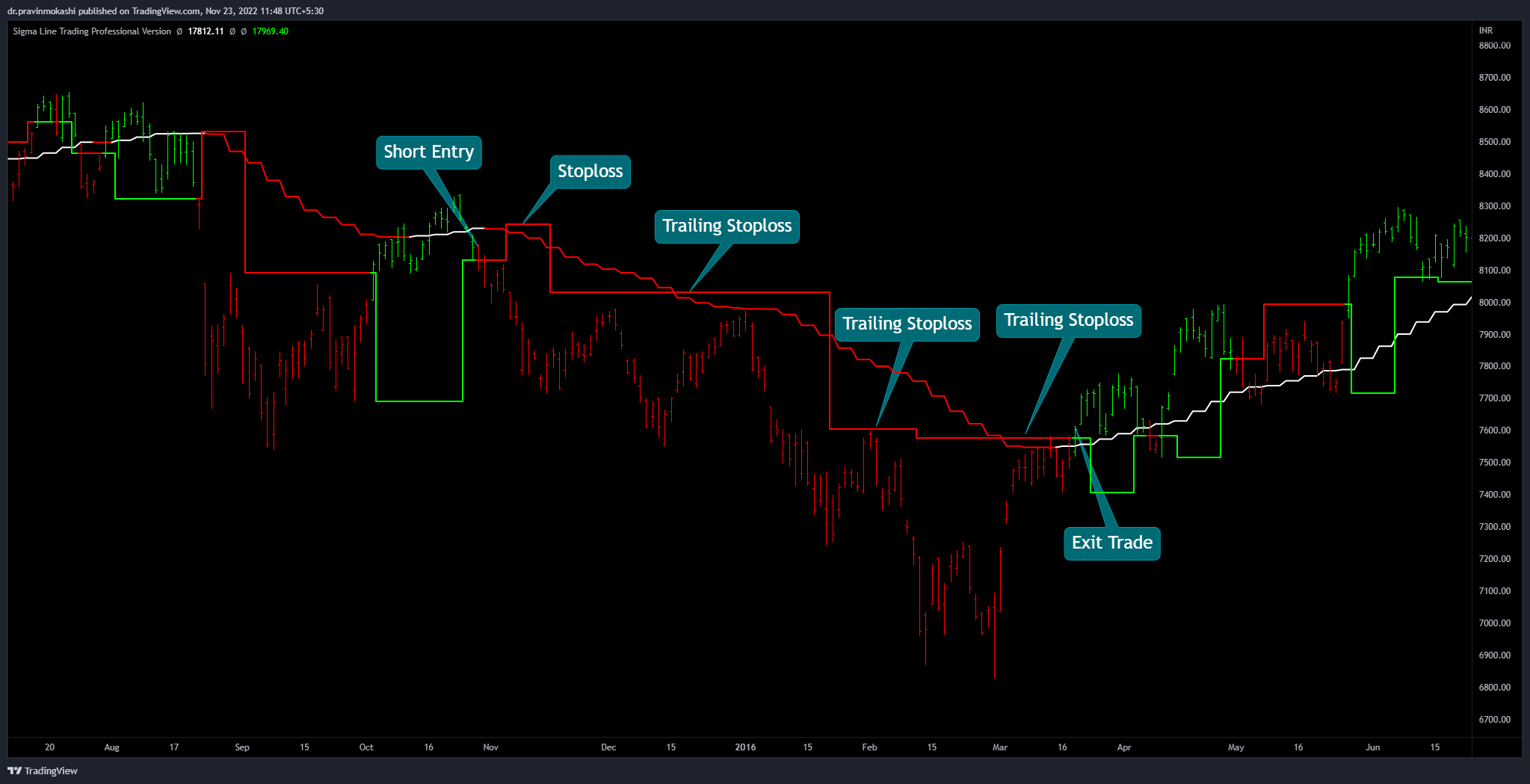

It’s a proven fact that markets have three trends viz. long term, medium term & short term. In sigma-line trading, Tide, Wave & Ripple lines reveal everything about the three trends, along with respective supports, resistances, targets & momentum.

Scalpers, intra-day, swing & positional traders as well as investors have been successfully using ‘One Best Method’ of in the markets of traded financial securities all over the world.

Let’s discuss the ‘One Best Method’ in just 3 steps.

1. Visit https://sigmalinetrading.com/faqs to watch video 1, 2 & 3 to understand how to login to Trading View software & get sigma line indicator. Also read the document Introduction to Sigma-Line Trading.

2. You will get a white price chart on the screen.

3. Select the stock, commodity, forex, etc. that you want to trade or invest.

4. Scalpers, intra-day, swing & positional traders as well as investors have been successfully using ‘One Best Method’ of using sigma lines in the markets of traded financial securities all over the world.

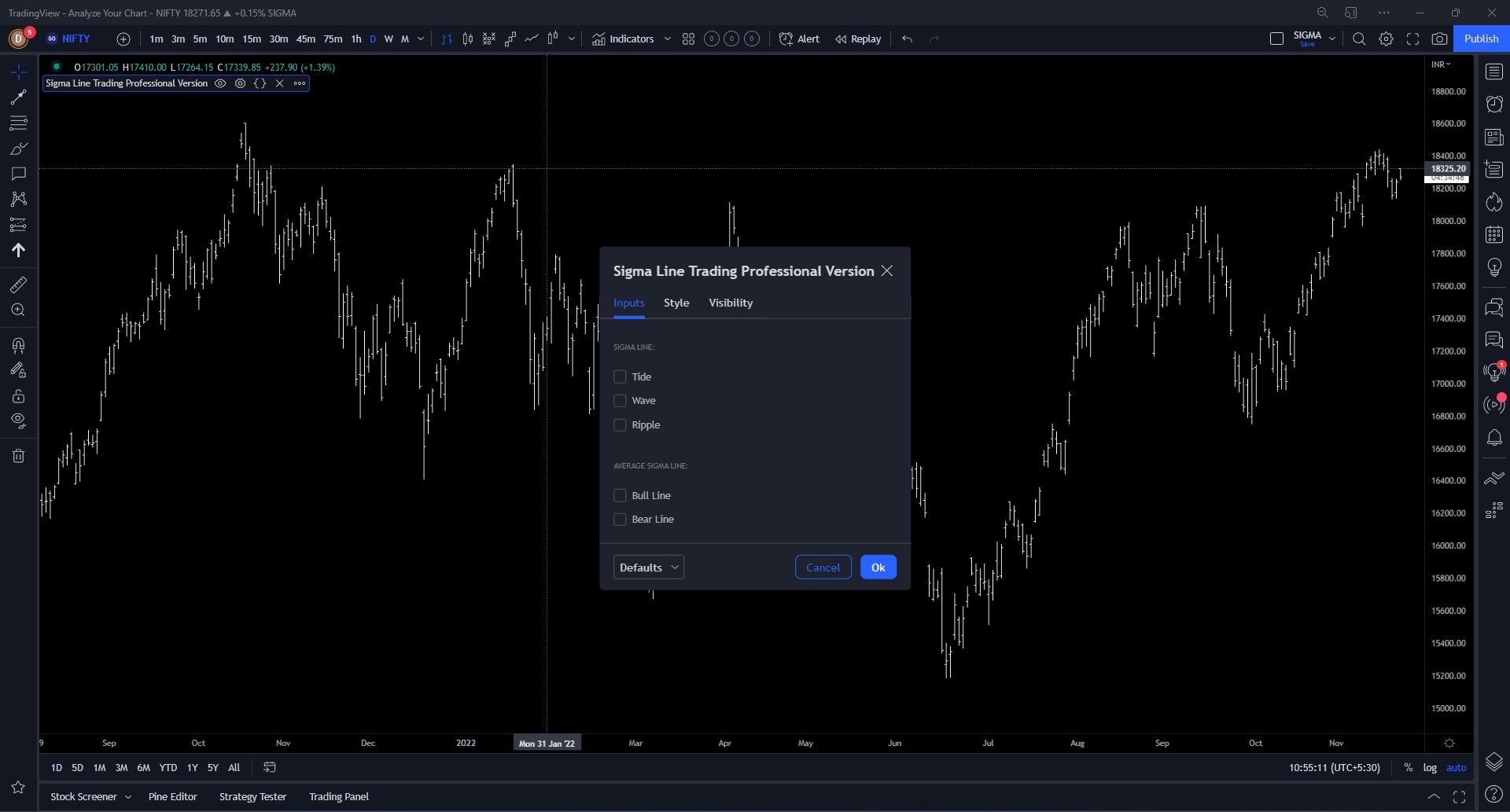

1. Click Settings

2. Select – Bull Line & Bear Line

3. Watch the price bar colour

It has taken over 10 years of research to discover the simplest system of trading & investing ever. Test this method on the earlier charts for scalping, intra-day, swing, positional & investing. Start practically using sigma lines only after watching at least 100 cases.